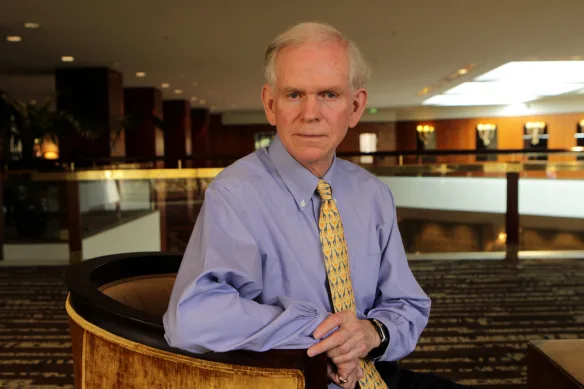

Jeremy Grantham, co-founder of GMO investment firm, warns that a financial market bubble is bursting, and the recent banking crisis is just the beginning of a more profound collapse. The frenzy in US markets and cheap money encouraging big risk-taking have created "one of the great bubbles of financial history." The bubble could result in a severe economic downturn, warns Grantham. He predicts that stocks' steep declines may lead to a fall of about 27% from current levels, and the worst-case scenario would be a plunge of more than 50%.

Grantham believes that bubbles in the stock market and the real estate market are poised to burst simultaneously, leading to a long period of economic stagnation. The US commercial real estate industry has been hit hard by rising interest rates, and the popularity of remote work has been particularly difficult for offices, says Grantham. Home prices in the US have also started to drop as mortgage rates have leaped.

Grantham blames central bankers for driving up the value of financial assets, setting the stage for crashes. He believes that interest rate hikes could mitigate the situation and suggests that the Federal Reserve stay the course on its rate hikes instead of buckling prematurely. He warned that these are not mild influences and are very clear and important.